Whether your business is payments, cash management, treasury or trade finance; whether you are a small local brokerage or a global multi-service bank; SWIFT India enables you to automate, standardise and consolidate your channels of communications with regulators, counterparties, market infrastructures and customers to conduct your business in a reliable, secure and efficient manner

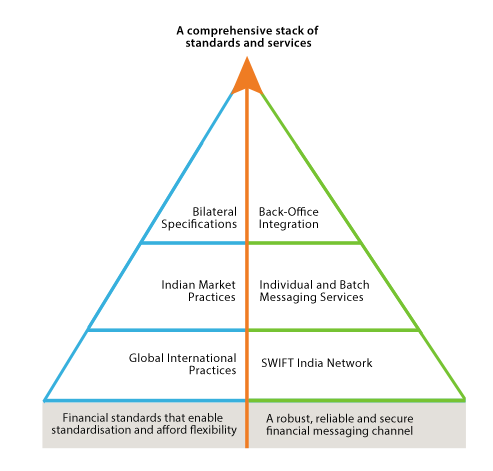

Comprehensive solutions

SWIFT India provides a comprehensive solution comprising of mesaging standards, infrastructure and security framework all backed by SWIFT SCRL’s world-class 24/7 premium support services. You can rely on us to

|

Payments and cash management Corporates face much competition and challenges in todays global market place, and therefore must operate efficiently, with confidence and predictability. Corporate treasurers can meet this challenge using SWIFT's comprehensive payments and cash management messaging services. |

|

Treasury To manage liquidity, credit, currency, interest rate and associated operational risks requires Corporate treasurers are required to efficiently manage working capital, exchange foreign currencies, take loans and make deposits, and use a variety of financial instruments to hedge financial risks. SWIFT India offers a comprehensive messaging solution to enable straight-through-processing of these instruments. |

|

Trade Finance Corporate treasurers support and enable complex business initiatives and projects within their organisations. To execute these projects requires timely execution of payments to suppliers in exchange for authenticated delivery of goods and services. SWIFT enables fully electronic trade finance instruments such as letters of credit, bank guarantees, open accounts and invoice financing instruments, which are key enablers in ensuring timely payments and managing of supply chain risks. |

|

Securities Corporate treasurers SWIFT is working with the market participants to provide solutions that aim at increasing efficiencies via standardisation and automation in the local Securities Markets, thus moving from largely fragmented and manual workflows to straight through processing via standardised messages, in line with global best practices |

Talk to a SWIFT expert